Mortgage Release Assumption . An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the. A mortgage assumption allows a homeowner to transfer their existing loan to another person. A simple assumption is where the buyer takes over on the mortgage payments from the seller. This means that the new borrower becomes responsible for paying off the. A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. An assumable mortgage is a type of home financing arrangement where an outstanding mortgage and its terms are transferred from the current owner to the buyer. This is a private transaction where title to the. An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms.

from www.signnow.com

This is a private transaction where title to the. An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the. An assumable mortgage is a type of home financing arrangement where an outstanding mortgage and its terms are transferred from the current owner to the buyer. A simple assumption is where the buyer takes over on the mortgage payments from the seller. This means that the new borrower becomes responsible for paying off the. A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms. A mortgage assumption allows a homeowner to transfer their existing loan to another person.

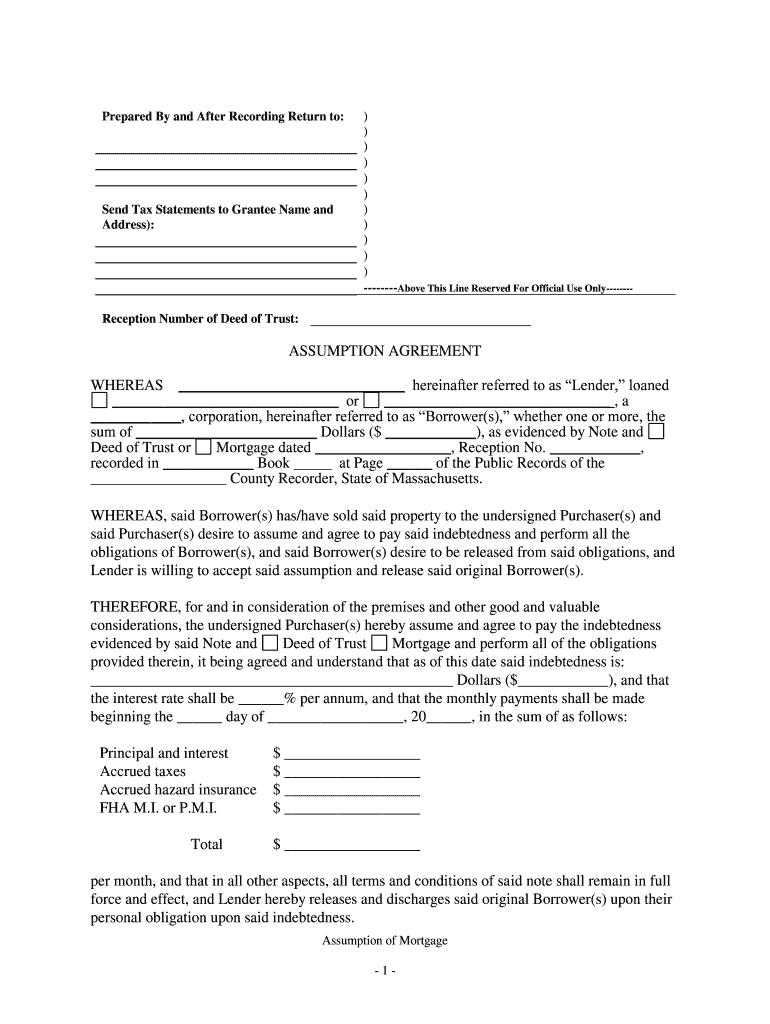

Assumption Agreement of Mortgage Form Fill Out and Sign Printable PDF

Mortgage Release Assumption An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms. An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms. An assumable mortgage is a type of home financing arrangement where an outstanding mortgage and its terms are transferred from the current owner to the buyer. A mortgage assumption allows a homeowner to transfer their existing loan to another person. This means that the new borrower becomes responsible for paying off the. A simple assumption is where the buyer takes over on the mortgage payments from the seller. A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the. This is a private transaction where title to the.

From www.charlotteclergycoalition.com

Mortgage Release Of Liability charlotte clergy coalition Mortgage Release Assumption A simple assumption is where the buyer takes over on the mortgage payments from the seller. A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. An assumable mortgage is a type of home financing arrangement where an outstanding mortgage and its terms are transferred from the current owner to the buyer. This is a private. Mortgage Release Assumption.

From www.dochub.com

Assumption Agreement of Mortgage and Release of Original Mortgagors Mortgage Release Assumption An assumable mortgage is a type of home financing arrangement where an outstanding mortgage and its terms are transferred from the current owner to the buyer. An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the. This means that the new. Mortgage Release Assumption.

From www.allbusinesstemplates.com

Mortgage Assumption Agreement Templates at Mortgage Release Assumption A mortgage assumption allows a homeowner to transfer their existing loan to another person. An assumable mortgage is a type of home financing arrangement where an outstanding mortgage and its terms are transferred from the current owner to the buyer. An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility. Mortgage Release Assumption.

From www.uslegalforms.com

New Jersey Assumption Agreement of Mortgage and Release of Original Mortgage Release Assumption A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. This is a private transaction where title to the. An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms. An assumable mortgage is a type of home financing. Mortgage Release Assumption.

From www.uslegalforms.com

Wisconsin Assumption Agreement of Mortgage and Release of Original Mortgage Release Assumption This is a private transaction where title to the. A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms. A mortgage assumption allows a homeowner to transfer their. Mortgage Release Assumption.

From www.signnow.com

Assumption Agreement of Mortgage and Release of Original Mortgagors Mortgage Release Assumption A mortgage assumption allows a homeowner to transfer their existing loan to another person. An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms. A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. An assumable mortgage is. Mortgage Release Assumption.

From www.template.net

8+ Assumption Agreement Templates Free Sample, Example Format Download Mortgage Release Assumption An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the. This means that the new borrower becomes responsible for paying off the. A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. A mortgage assumption allows a. Mortgage Release Assumption.

From www.uslegalforms.com

Indiana Assumption Agreement of Mortgage and Release of Original Mortgage Release Assumption A mortgage assumption allows a homeowner to transfer their existing loan to another person. A simple assumption is where the buyer takes over on the mortgage payments from the seller. An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the. A. Mortgage Release Assumption.

From www.uslegalforms.com

New Jersey Assumption Agreement of Mortgage and Release of Original Mortgage Release Assumption An assumable mortgage is a type of home financing arrangement where an outstanding mortgage and its terms are transferred from the current owner to the buyer. This means that the new borrower becomes responsible for paying off the. A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. This is a private transaction where title to. Mortgage Release Assumption.

From www.uslegalforms.com

Florida Assumption Agreement of Mortgage and Release of Original Mortgage Release Assumption This means that the new borrower becomes responsible for paying off the. A mortgage assumption allows a homeowner to transfer their existing loan to another person. An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms. This is a private transaction where. Mortgage Release Assumption.

From www.uslegalforms.com

New York Assumption Agreement of Mortgage and Release of Original Mortgage Release Assumption An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms. This is a private transaction where title to the. A mortgage assumption allows a homeowner to transfer their existing loan to another person. An assumable mortgage is a type of home financing. Mortgage Release Assumption.

From www.signnow.com

Assumption Agreement of Mortgage and Release of Original Mortgagors Mortgage Release Assumption This means that the new borrower becomes responsible for paying off the. An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms. A mortgage assumption allows a homeowner to transfer their existing loan to another person. This is a private transaction where. Mortgage Release Assumption.

From www.uslegalforms.com

Mortgage Assumption Agreement Pdf Fill and Sign Printable Template Mortgage Release Assumption This means that the new borrower becomes responsible for paying off the. A simple assumption is where the buyer takes over on the mortgage payments from the seller. An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the. An assumable mortgage. Mortgage Release Assumption.

From www.signnow.com

Assumption Agreement of Mortgage and Release of Original Mortgagors Mortgage Release Assumption A simple assumption is where the buyer takes over on the mortgage payments from the seller. This is a private transaction where title to the. A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for. Mortgage Release Assumption.

From www.signnow.com

Assumption Agreement of Mortgage Form Fill Out and Sign Printable PDF Mortgage Release Assumption This means that the new borrower becomes responsible for paying off the. An assumable mortgage is a type of home financing arrangement where an outstanding mortgage and its terms are transferred from the current owner to the buyer. This is a private transaction where title to the. A mortgage assumption allows a homeowner to transfer their existing loan to another. Mortgage Release Assumption.

From pt.scribd.com

Deed of Sale of Motor Vehicle With Assumption of Mortgage Private Law Mortgage Release Assumption A mortgage assumption allows a homeowner to transfer their existing loan to another person. This means that the new borrower becomes responsible for paying off the. An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing mortgage and all of the terms. This is a private transaction where. Mortgage Release Assumption.

From www.signnow.com

Assumption Agreement of Mortgage and Release of Original Mortgagors Mortgage Release Assumption This is a private transaction where title to the. This means that the new borrower becomes responsible for paying off the. A mortgage assumption occurs when a new borrower takes over an existing borrower’s mortgage. An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to. Mortgage Release Assumption.

From www.uslegalforms.com

Notice to Homeowner Assumption of HUD FHA Insured Mortgages Release Mortgage Release Assumption This is a private transaction where title to the. An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the. An assumable mortgage is a special type of home financing that allows a homebuyer to take over (or, assume) the seller’s existing. Mortgage Release Assumption.